Superconducting Qubit Hardware Development in 2025: Unveiling the Next Era of Quantum Computing. Explore the Innovations, Market Dynamics, and Strategic Roadmaps Shaping the Future.

- Executive Summary: Key Findings and 2025 Outlook

- Market Size, Growth, and Forecasts (2025–2030): Projected 30% CAGR

- Technology Landscape: State-of-the-Art Superconducting Qubit Architectures

- Key Players and Competitive Analysis

- Recent Breakthroughs and Research Milestones

- Manufacturing Challenges and Scalability Solutions

- Investment Trends and Funding Landscape

- Emerging Applications and Industry Use Cases

- Regulatory, Standardization, and Ecosystem Developments

- Future Outlook: Roadmap to Fault-Tolerant Quantum Computing

- Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

Superconducting qubit hardware remains at the forefront of quantum computing research and commercialization, with 2024 marking significant advancements in qubit coherence, gate fidelity, and system scalability. The year saw leading technology companies and research institutions push the boundaries of device integration, error correction, and quantum volume, setting the stage for a pivotal 2025.

Key findings from 2024 highlight that superconducting qubits continue to dominate the quantum hardware landscape due to their compatibility with established semiconductor fabrication techniques and their rapid gate operations. International Business Machines Corporation (IBM) and Rigetti & Co, LLC both announced new multi-qubit processors with improved error rates and longer coherence times, while Google LLC demonstrated progress in scaling up their Sycamore architecture. These developments have been underpinned by innovations in materials science, cryogenic engineering, and control electronics.

A major trend in 2024 was the transition from noisy intermediate-scale quantum (NISQ) devices toward hardware capable of supporting error-corrected logical qubits. IBM’s Quantum Roadmap outlined plans for modular quantum processors and the integration of quantum communication links, aiming to surpass the 1,000-qubit threshold by 2025. Meanwhile, Rigetti & Co, LLC and Quantinuum Ltd. focused on improving two-qubit gate fidelities and reducing crosstalk, essential for practical quantum error correction.

Looking ahead to 2025, the outlook for superconducting qubit hardware is optimistic. Industry leaders are expected to unveil processors with thousands of physical qubits, enhanced by robust error mitigation and early-stage error correction. Collaborations between hardware developers and national laboratories, such as those led by National Institute of Standards and Technology (NIST) and Argonne National Laboratory, are anticipated to accelerate breakthroughs in device reliability and manufacturability. The sector is also likely to see increased investment in hybrid quantum-classical systems and the development of application-specific quantum processors.

In summary, 2024’s progress in superconducting qubit hardware sets a strong foundation for 2025, with the industry poised for further breakthroughs in scalability, fidelity, and practical quantum computing applications.

Market Size, Growth, and Forecasts (2025–2030): Projected 30% CAGR

The global market for superconducting qubit hardware is poised for remarkable expansion between 2025 and 2030, driven by accelerating investments in quantum computing research, increasing commercialization efforts, and growing demand from sectors such as pharmaceuticals, finance, and materials science. Industry analysts project a compound annual growth rate (CAGR) of approximately 30% during this period, reflecting both the nascent stage of the technology and the rapid pace of innovation.

Key players—including International Business Machines Corporation (IBM), Rigetti Computing, Inc., and Google LLC—are scaling up their superconducting qubit hardware platforms, with roadmaps targeting devices of hundreds to thousands of qubits by the end of the decade. These companies are investing heavily in fabrication facilities, error correction research, and cryogenic infrastructure, all of which are essential for the reliable operation of superconducting qubits.

The market’s growth is further supported by government initiatives and public-private partnerships. For example, the U.S. Department of Energy Office of Science and the European Quantum Industry Consortium (QuIC) are funding large-scale quantum hardware development projects, fostering collaboration between academia and industry. These efforts are expected to accelerate the transition from laboratory prototypes to commercially viable quantum processors.

From a regional perspective, North America currently leads in superconducting qubit hardware development, but Europe and Asia-Pacific are rapidly increasing their investments and capabilities. The emergence of new entrants and specialized suppliers—such as Bluefors Oy (cryogenics) and Oxford Instruments plc (quantum measurement systems)—is also contributing to a more robust and competitive ecosystem.

Looking ahead to 2030, the market is expected to be shaped by advances in qubit coherence times, scalable chip architectures, and improved quantum error correction. As these technical milestones are achieved, the addressable market for superconducting qubit hardware will expand beyond research institutions to include enterprise and cloud-based quantum computing services, further fueling growth at the projected 30% CAGR.

Technology Landscape: State-of-the-Art Superconducting Qubit Architectures

Superconducting qubit hardware has rapidly advanced, establishing itself as a leading platform in the race toward practical quantum computing. The state-of-the-art in 2025 is characterized by significant improvements in qubit coherence times, gate fidelities, and scalable architectures, driven by both academic research and industrial innovation.

The most prevalent superconducting qubit design remains the transmon, a variant of the charge qubit that offers reduced sensitivity to charge noise. Companies such as International Business Machines Corporation (IBM) and Google LLC have refined transmon-based architectures, achieving single- and two-qubit gate fidelities exceeding 99.9%. These advances are underpinned by improvements in materials, fabrication processes, and microwave control electronics.

A key trend in 2025 is the move toward modular and error-corrected architectures. Rigetti & Co, Inc. and Oxford Quantum Circuits Ltd are developing modular quantum processors, where multiple chips are interconnected to form larger, more powerful systems. This modularity is essential for scaling beyond the limitations of single-chip devices and for implementing surface code error correction, which requires large numbers of physical qubits to encode a single logical qubit.

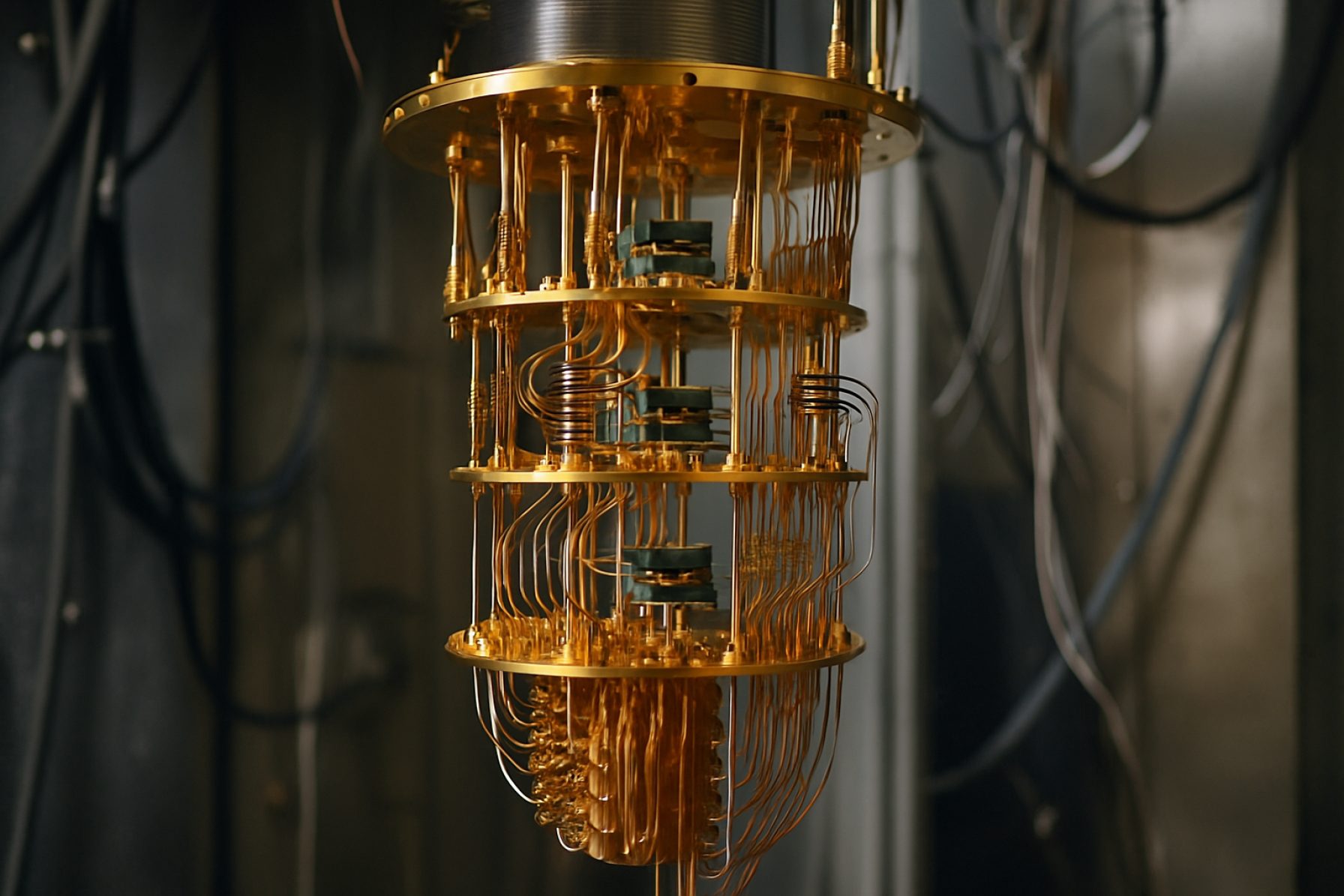

Another notable development is the integration of three-dimensional (3D) packaging and advanced cryogenic infrastructure. Intel Corporation has pioneered the use of 3D integration to reduce crosstalk and improve signal integrity, while Bluefors Oy and Oxford Instruments plc provide the ultra-low temperature environments necessary for stable qubit operation.

Looking forward, the field is exploring alternative superconducting qubit modalities, such as fluxonium and Andreev qubits, which promise even longer coherence times and improved noise resilience. Collaborative efforts between industry and academia, such as those led by National Institute of Standards and Technology (NIST), continue to push the boundaries of qubit performance and integration.

In summary, the superconducting qubit hardware landscape in 2025 is defined by high-fidelity, scalable, and increasingly modular architectures, setting the stage for the next generation of fault-tolerant quantum computers.

Key Players and Competitive Analysis

The superconducting qubit hardware landscape in 2025 is characterized by intense competition among leading technology companies, research institutions, and emerging startups, all striving to achieve scalable, fault-tolerant quantum computing. The field is dominated by a few major players, each leveraging unique technological approaches and proprietary fabrication techniques to advance qubit coherence, gate fidelity, and system integration.

Among the frontrunners, International Business Machines Corporation (IBM) continues to set benchmarks with its roadmap for large-scale quantum processors, focusing on transmon qubits and advanced cryogenic packaging. IBM’s open-access quantum systems and Qiskit software ecosystem have fostered a robust developer community, accelerating hardware-software co-design. Google LLC remains a key competitor, with its Sycamore and subsequent processors demonstrating significant milestones in quantum supremacy and error mitigation. Google’s emphasis on surface code error correction and scalable chip architectures positions it as a leader in the race toward practical quantum advantage.

Rigetti & Co, Inc. distinguishes itself with a modular approach, developing multi-chip quantum processors and hybrid quantum-classical cloud services. Their focus on rapid prototyping and integration with classical computing resources appeals to enterprise and research clients seeking flexible quantum solutions. Oxford Quantum Circuits Ltd (OQC) in the UK is gaining traction with its patented Coaxmon qubit design, emphasizing high coherence and scalable 3D architectures.

In Asia, Alibaba Group Holding Limited and Baidu, Inc. are investing heavily in superconducting qubit research, establishing dedicated quantum labs and collaborating with academic institutions to accelerate hardware breakthroughs. Meanwhile, D-Wave Systems Inc. continues to innovate in quantum annealing, while also exploring gate-model superconducting qubits for broader computational applications.

The competitive landscape is further shaped by strategic partnerships, government funding, and open-source initiatives. Collaborations between hardware developers and national laboratories, such as those with National Institute of Standards and Technology (NIST) and Argonne National Laboratory, are critical for advancing materials science and cryogenic engineering. As the field matures, differentiation increasingly hinges on error correction capabilities, qubit connectivity, and the ability to manufacture at scale, setting the stage for rapid progress and potential market consolidation in the coming years.

Recent Breakthroughs and Research Milestones

In 2025, superconducting qubit hardware development has witnessed several significant breakthroughs, further solidifying its position as a leading platform for quantum computing. One of the most notable advancements is the demonstration of error rates below the so-called “fault-tolerance threshold” in multi-qubit systems. This achievement, reported by IBM and Google, marks a critical step toward scalable, error-corrected quantum processors. Both companies have showcased devices with over 100 qubits, with improved coherence times and gate fidelities, enabling more complex quantum algorithms to be executed reliably.

Another milestone is the integration of advanced cryogenic control electronics, which has reduced the physical footprint and power consumption of quantum processors. Rigetti Computing and Quantinuum have introduced modular architectures that allow for the seamless addition of qubit tiles, paving the way for larger, more flexible quantum systems. These modular approaches also facilitate rapid prototyping and testing of new qubit designs, accelerating the pace of innovation.

Material science breakthroughs have also played a pivotal role. Researchers at National Institute of Standards and Technology (NIST) and Argonne National Laboratory have developed new superconducting materials and fabrication techniques that minimize defects and noise sources, leading to longer qubit lifetimes and higher operational stability. These improvements are crucial for implementing quantum error correction codes and achieving practical quantum advantage.

Furthermore, the adoption of hybrid quantum-classical workflows has been enhanced by the development of high-speed, low-latency interconnects between quantum processors and classical control systems. This has enabled real-time feedback and adaptive error mitigation strategies, as demonstrated by IBM in their latest quantum cloud services.

Collectively, these research milestones in 2025 underscore the rapid progress in superconducting qubit hardware, bringing the field closer to realizing fault-tolerant, large-scale quantum computers capable of solving classically intractable problems.

Manufacturing Challenges and Scalability Solutions

The development of superconducting qubit hardware faces significant manufacturing challenges as the field moves from laboratory-scale prototypes to scalable quantum processors. One of the primary obstacles is the precise fabrication of Josephson junctions, the core nonlinear elements in superconducting qubits. These junctions require nanometer-scale control over material deposition and patterning, as even minor variations can lead to substantial differences in qubit performance and coherence times. Achieving uniformity across large wafers is particularly difficult, impacting yield and device reproducibility.

Another challenge is the integration of increasingly complex qubit architectures. As the number of qubits grows, so does the need for high-density interconnects and advanced packaging solutions that minimize crosstalk and thermal noise. Traditional wire bonding and packaging methods are insufficient for large-scale quantum processors, prompting the development of three-dimensional integration and through-silicon vias. These approaches, while promising, introduce new sources of loss and require further refinement to maintain qubit fidelity.

Material defects and surface losses also remain critical issues. Superconducting qubits are highly sensitive to microscopic impurities and two-level system (TLS) defects at interfaces, which can degrade coherence. Manufacturers are investing in advanced material purification, surface treatments, and novel substrate choices to mitigate these effects. For example, the use of high-purity aluminum and sapphire substrates, along with improved cleaning protocols, has led to measurable improvements in device performance.

To address scalability, leading organizations are adopting semiconductor industry techniques such as photolithography and automated wafer-scale processing. International Business Machines Corporation (IBM) and Rigetti & Co, Inc. have both reported progress in fabricating multi-qubit chips using these methods, enabling higher throughput and consistency. Additionally, the development of modular quantum processor units (QPUs) allows for parallel manufacturing and testing, facilitating the assembly of larger quantum systems.

Collaboration with established semiconductor foundries is also accelerating progress. Intel Corporation has leveraged its expertise in advanced packaging and process control to address yield and integration challenges in superconducting qubit fabrication. These partnerships are crucial for transitioning quantum hardware from bespoke laboratory devices to commercially viable products.

In summary, while significant manufacturing and scalability challenges remain, ongoing innovations in materials, fabrication techniques, and system integration are steadily advancing the field toward practical, large-scale superconducting quantum computers.

Investment Trends and Funding Landscape

The investment landscape for superconducting qubit hardware development in 2025 is characterized by robust funding from both private and public sectors, reflecting the technology’s central role in the race toward practical quantum computing. Venture capital continues to flow into startups and scale-ups focused on advancing qubit coherence times, error correction, and scalable architectures. Notably, established technology giants such as IBM and Google maintain significant internal investment, with dedicated quantum research divisions and partnerships with academic institutions to accelerate hardware breakthroughs.

Government funding remains a critical driver, particularly in the United States, Europe, and Asia. Initiatives like the U.S. National Quantum Initiative, the European Quantum Flagship, and Japan’s Quantum Leap Flagship Program have allocated substantial resources to superconducting qubit research, supporting both fundamental science and commercialization efforts. These programs often foster collaboration between universities, national laboratories, and industry, creating a fertile environment for innovation and technology transfer.

Corporate venture arms and strategic investors are increasingly active, seeking early access to quantum technologies that could disrupt sectors such as cryptography, materials science, and pharmaceuticals. For example, Intel Corporation and Samsung Electronics have made targeted investments in quantum hardware startups, while also developing in-house superconducting qubit platforms. Additionally, specialized quantum-focused funds have emerged, providing capital and expertise tailored to the unique challenges of quantum hardware development.

The funding landscape is also shaped by the growing ecosystem of quantum hardware suppliers and fabrication partners. Companies like Rigetti Computing and Quantinuum have secured multi-round financing to expand their manufacturing capabilities and pursue commercial deployment of superconducting quantum processors. Strategic alliances between hardware developers and cloud service providers, such as Google Cloud and IBM Quantum, further amplify investment by enabling broader access to quantum computing resources and accelerating user-driven innovation.

Overall, the 2025 funding environment for superconducting qubit hardware is marked by increasing deal sizes, a maturing investor base, and a shift toward later-stage investments as the field moves closer to demonstrating quantum advantage in real-world applications.

Emerging Applications and Industry Use Cases

Superconducting qubit hardware has rapidly evolved from laboratory prototypes to platforms with real-world potential, driving a surge in emerging applications and industry use cases as of 2025. The unique properties of superconducting qubits—such as fast gate times, scalability, and compatibility with existing semiconductor fabrication techniques—have positioned them at the forefront of quantum computing research and commercialization.

One of the most prominent applications is in quantum simulation, where superconducting qubit systems are used to model complex quantum phenomena that are intractable for classical computers. This capability is particularly valuable in materials science and chemistry, enabling companies to explore new catalysts, optimize battery materials, and design novel pharmaceuticals. For example, IBM and Rigetti Computing have both demonstrated quantum simulations of molecular structures using their superconducting qubit platforms, collaborating with industry partners in the chemical and pharmaceutical sectors.

Financial services are another sector actively exploring superconducting qubit hardware. Quantum algorithms for portfolio optimization, risk analysis, and fraud detection are being tested on quantum processors developed by IBM and Google Quantum AI. These early-stage applications aim to provide a computational edge in processing vast datasets and solving optimization problems more efficiently than classical systems.

In logistics and supply chain management, superconducting qubit hardware is being leveraged to tackle complex routing and scheduling problems. D-Wave Quantum Inc. and IBM have partnered with logistics companies to pilot quantum-enhanced solutions that could lead to significant cost savings and efficiency improvements.

Emerging use cases also include quantum machine learning, where superconducting qubits are used to accelerate training and inference for certain classes of models. This is being explored by technology leaders such as Google Quantum AI and IBM, who are collaborating with academic and industrial partners to develop hybrid quantum-classical algorithms.

As superconducting qubit hardware matures, its integration into cloud-based quantum computing services is expanding access for researchers and enterprises. This democratization of quantum resources is expected to further accelerate the discovery of new applications and industry use cases in the coming years.

Regulatory, Standardization, and Ecosystem Developments

The landscape of superconducting qubit hardware development in 2025 is increasingly shaped by regulatory frameworks, standardization efforts, and the maturation of a collaborative ecosystem. As quantum computing transitions from laboratory research to early-stage commercialization, regulatory bodies and industry consortia are working to establish guidelines that ensure interoperability, safety, and ethical deployment of quantum technologies.

Standardization is a critical focus, with organizations such as the Institute of Electrical and Electronics Engineers (IEEE) and the International Organization for Standardization (ISO) leading initiatives to define benchmarks for qubit performance, error rates, and device interfaces. These standards are essential for enabling cross-platform compatibility and fostering a competitive marketplace where hardware from different vendors can be integrated into larger quantum systems. In 2025, the IEEE’s P7130 working group continues to refine terminology and metrics for quantum computing, while ISO/IEC JTC 1/SC 42 is expanding its scope to include quantum-specific standards.

Regulatory developments are also gaining momentum. Governments in the United States, European Union, and Asia-Pacific are investing in quantum technology through national strategies and funding programs, while also considering export controls and cybersecurity requirements. For example, the National Institute of Standards and Technology (NIST) in the U.S. is actively involved in post-quantum cryptography standards, which have implications for the secure deployment of superconducting qubit systems. The European Commission is similarly supporting quantum hardware development through the Quantum Flagship initiative, emphasizing both innovation and regulatory compliance.

The ecosystem supporting superconducting qubit hardware is becoming more interconnected, with partnerships between hardware manufacturers, software developers, and research institutions. Companies such as IBM, Rigetti Computing, and Quantinuum are collaborating with universities and government labs to accelerate technology transfer and workforce development. Industry alliances, such as the Quantum Economic Development Consortium (QED-C), are facilitating pre-competitive research and advocating for common standards.

In summary, 2025 marks a pivotal year for regulatory, standardization, and ecosystem developments in superconducting qubit hardware. These efforts are laying the groundwork for scalable, secure, and interoperable quantum computing platforms, ensuring that the technology can meet both commercial and societal needs as it matures.

Future Outlook: Roadmap to Fault-Tolerant Quantum Computing

The pursuit of fault-tolerant quantum computing hinges critically on the advancement of superconducting qubit hardware. As of 2025, the field is witnessing rapid progress in both the scaling and reliability of superconducting qubit systems. The roadmap to fault tolerance involves overcoming key challenges: increasing qubit coherence times, reducing gate and measurement errors, and integrating robust error correction protocols.

Leading industry players and research institutions are focusing on materials engineering and fabrication techniques to minimize sources of decoherence. For instance, improvements in substrate quality, surface treatments, and the use of novel superconducting materials are being actively explored to extend qubit lifetimes. IBM and Google Quantum AI have both reported significant gains in coherence times and gate fidelities, with multi-qubit devices now routinely achieving error rates below 1%. These advances are essential for implementing logical qubits, which are the building blocks of fault-tolerant architectures.

Another critical aspect is the scaling of qubit arrays. The integration of hundreds, and soon thousands, of superconducting qubits on a single chip is being enabled by innovations in chip packaging, cryogenic control electronics, and interconnect technologies. Rigetti Computing and Oxford Quantum Circuits are among the organizations developing modular architectures that facilitate the scaling of quantum processors while maintaining high connectivity and low cross-talk between qubits.

Error correction remains a central focus, with the surface code emerging as a leading candidate for practical fault tolerance. Demonstrations of small-scale logical qubits and repeated error detection cycles have been achieved, marking important milestones. The next steps involve increasing the code distance and demonstrating logical error rates that are exponentially suppressed relative to physical error rates. Collaborative efforts, such as those led by National Institute of Standards and Technology (NIST) and National Science Foundation (NSF), are accelerating research into scalable error correction and benchmarking protocols.

Looking ahead, the roadmap to fault-tolerant quantum computing with superconducting qubits will require continued interdisciplinary innovation. Advances in materials science, device engineering, cryogenics, and quantum software will collectively drive the field toward the realization of practical, large-scale quantum computers in the coming years.

Strategic Recommendations for Stakeholders

As the field of superconducting qubit hardware continues to evolve rapidly, stakeholders—including hardware manufacturers, research institutions, investors, and end-users—must adopt forward-looking strategies to remain competitive and foster innovation. The following strategic recommendations are tailored to the landscape anticipated in 2025:

- Prioritize Scalable Fabrication Techniques: Stakeholders should invest in scalable and reproducible fabrication processes to address the challenges of increasing qubit counts while maintaining high coherence times and low error rates. Collaborations with established semiconductor foundries, such as IBM and Intel Corporation, can accelerate the transition from laboratory prototypes to manufacturable devices.

- Enhance Materials Research: Continued research into novel superconducting materials and interface engineering is essential. Partnerships with academic institutions and materials science organizations, such as National Institute of Standards and Technology (NIST), can yield breakthroughs in reducing noise and improving qubit performance.

- Standardize Benchmarking and Metrics: The adoption of industry-wide standards for benchmarking qubit performance, such as those promoted by IEEE, will facilitate transparent comparison and foster trust among users and investors. Stakeholders should actively participate in standardization initiatives to shape the metrics that define hardware quality.

- Invest in Cryogenic and Control Infrastructure: Superconducting qubits require advanced cryogenic systems and high-fidelity control electronics. Collaborating with specialized suppliers like Bluefors Oy for cryogenics and RIGOL Technologies, Inc. for control hardware can help ensure reliable system integration and operation.

- Foster Open Innovation and Ecosystem Development: Engaging in open-source hardware and software initiatives, such as those led by Google Quantum AI, can accelerate collective progress and attract a broader talent pool. Building a robust ecosystem around superconducting qubit platforms will be critical for long-term adoption and application development.

By implementing these strategies, stakeholders can address technical bottlenecks, reduce time-to-market, and position themselves at the forefront of superconducting qubit hardware development in 2025 and beyond.

Sources & References

- International Business Machines Corporation (IBM)

- Rigetti & Co, LLC

- Google LLC

- Quantinuum Ltd.

- National Institute of Standards and Technology (NIST)

- Bluefors Oy

- Oxford Instruments plc

- Google LLC

- Oxford Quantum Circuits Ltd

- Alibaba Group Holding Limited

- Google Cloud

- D-Wave Quantum Inc.

- Institute of Electrical and Electronics Engineers (IEEE)

- International Organization for Standardization (ISO)

- European Commission

- National Science Foundation (NSF)

- RIGOL Technologies, Inc.