High-Throughput Metabolomics Market Report 2025: Unveiling Key Growth Drivers, Technological Innovations, and Global Forecasts. Explore Market Dynamics, Competitive Strategies, and Future Opportunities Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in High-Throughput Metabolomics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Market Barriers

- Opportunities and Future Outlook: Emerging Applications and Investment Hotspots

- Sources & References

Executive Summary & Market Overview

High-throughput metabolomics refers to the large-scale, rapid analysis of small-molecule metabolites within biological systems, leveraging advanced analytical platforms and automation to process hundreds to thousands of samples efficiently. This approach is revolutionizing systems biology, drug discovery, clinical diagnostics, and personalized medicine by enabling comprehensive metabolic profiling at unprecedented speed and scale.

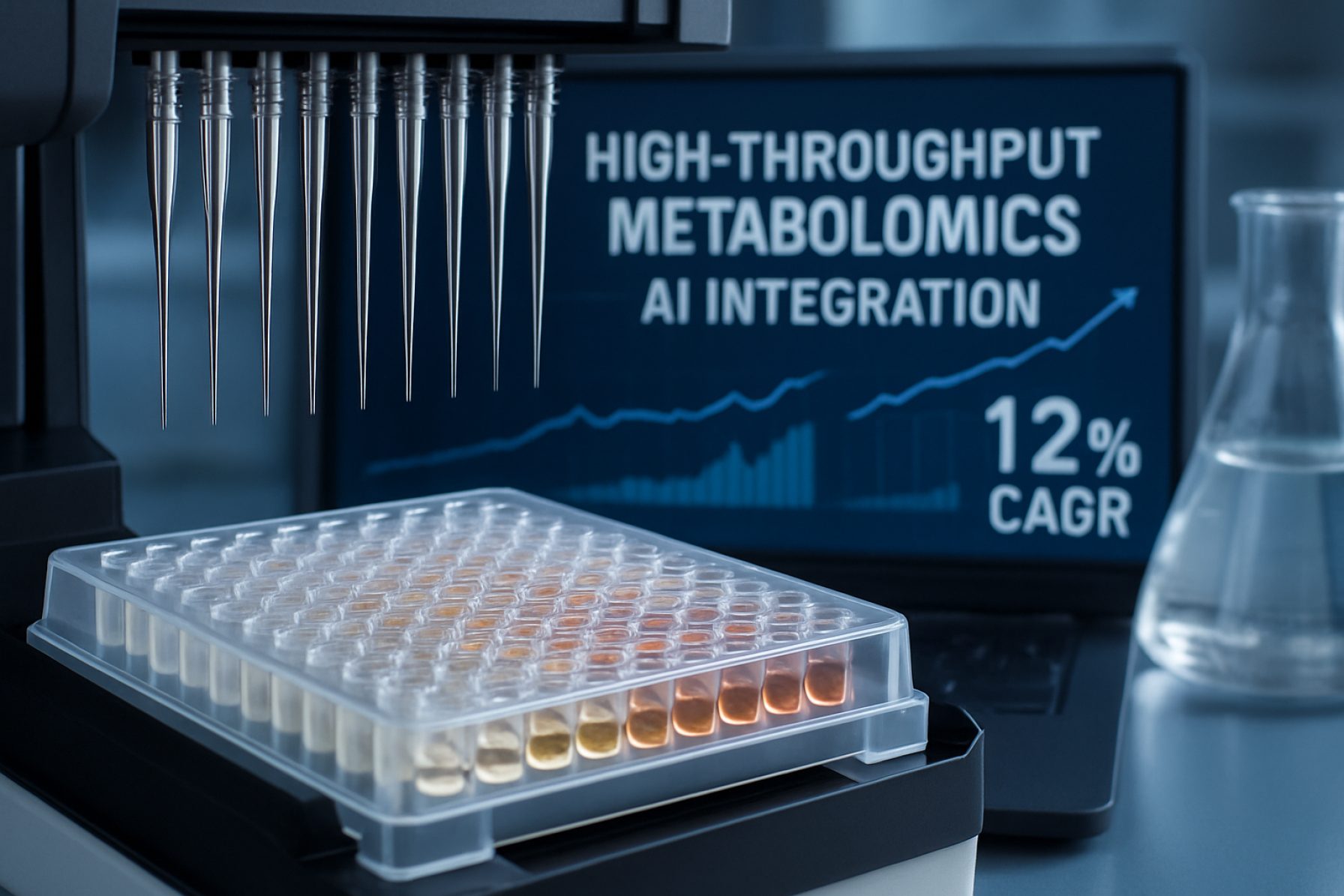

In 2025, the global high-throughput metabolomics market is experiencing robust growth, driven by technological advancements in mass spectrometry, nuclear magnetic resonance (NMR), and chromatography, as well as the integration of artificial intelligence (AI) and machine learning for data analysis. The increasing demand for biomarker discovery, disease pathway elucidation, and precision medicine is fueling adoption across pharmaceutical, biotechnology, and academic research sectors. According to Grand View Research, the overall metabolomics market was valued at USD 2.8 billion in 2023 and is projected to expand at a CAGR of over 11% through 2030, with high-throughput platforms representing a significant and growing segment.

Key market drivers include:

- Rising prevalence of chronic diseases and the need for early, accurate diagnostics.

- Expansion of biopharmaceutical R&D pipelines, where high-throughput metabolomics accelerates target identification and validation.

- Government and private funding for omics research, particularly in North America and Europe.

- Emergence of automated sample preparation and data processing solutions, reducing bottlenecks and labor costs.

Major industry players such as Agilent Technologies, Thermo Fisher Scientific, and Bruker Corporation are investing heavily in high-throughput instrumentation and software, while specialized service providers like Metabolon are expanding their global reach and service portfolios.

Regionally, North America leads the market due to strong research infrastructure and funding, while Asia-Pacific is witnessing the fastest growth, propelled by expanding pharmaceutical manufacturing and increasing adoption of precision medicine initiatives (MarketsandMarkets).

In summary, high-throughput metabolomics is poised for significant expansion in 2025, underpinned by technological innovation, growing biomedical applications, and increasing investment from both public and private sectors.

Key Technology Trends in High-Throughput Metabolomics

High-throughput metabolomics refers to the large-scale, rapid analysis of metabolites within biological samples, enabling comprehensive profiling of metabolic states across numerous samples in a short timeframe. As of 2025, the field is experiencing significant technological advancements that are reshaping both research and clinical applications.

One of the most prominent trends is the integration of advanced mass spectrometry (MS) platforms with automated sample preparation and data acquisition systems. Innovations such as ultra-high-performance liquid chromatography (UHPLC) coupled with high-resolution MS are now standard, offering improved sensitivity, speed, and reproducibility. Automated workflows, including robotic liquid handling and multiplexed sample processing, are reducing manual intervention and increasing throughput, as highlighted by Thermo Fisher Scientific and Agilent Technologies.

Another key trend is the adoption of artificial intelligence (AI) and machine learning (ML) for data analysis. These tools are essential for managing the vast datasets generated by high-throughput platforms, enabling more accurate metabolite identification, quantification, and pattern recognition. Companies such as Bruker Corporation are incorporating AI-driven software into their metabolomics solutions, streamlining data interpretation and facilitating biomarker discovery.

Miniaturization and microfluidics are also gaining traction, allowing for reduced sample volumes and reagent consumption while maintaining analytical performance. Microfluidic devices are being developed for parallel processing of hundreds of samples, which is particularly valuable in clinical and pharmaceutical research settings. According to MarketsandMarkets, the adoption of microfluidic-based metabolomics platforms is expected to accelerate, driven by the demand for cost-effective and scalable solutions.

Cloud-based data management and collaborative platforms are further transforming the landscape. Secure, scalable cloud solutions enable real-time data sharing and multi-site collaborations, which are critical for large-scale studies and consortia. Providers like Waters Corporation are offering integrated informatics platforms that support seamless data storage, analysis, and sharing.

Collectively, these technology trends are propelling high-throughput metabolomics toward greater scalability, automation, and analytical power, positioning the field for expanded applications in precision medicine, drug discovery, and systems biology in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of the high-throughput metabolomics market in 2025 is characterized by a dynamic mix of established life sciences companies, specialized metabolomics firms, and emerging technology providers. The market is driven by increasing demand for large-scale metabolic profiling in pharmaceutical research, clinical diagnostics, and systems biology, prompting both organic growth and strategic collaborations.

Key players dominating the sector include Agilent Technologies, Thermo Fisher Scientific, and Bruker Corporation. These companies leverage their robust mass spectrometry and chromatography platforms, offering integrated solutions tailored for high-throughput workflows. Their global reach, extensive R&D investments, and comprehensive product portfolios position them as preferred partners for academic and industrial clients alike.

Specialized firms such as Metabolon and Biomark focus on proprietary metabolomics platforms and data analytics, often providing end-to-end services from sample preparation to bioinformatics. These companies differentiate themselves through advanced automation, high sample throughput, and deep expertise in data interpretation, catering to pharmaceutical, agricultural, and clinical research markets.

Emerging players and startups are also shaping the competitive landscape by introducing novel technologies such as microfluidics-based sample processing, AI-driven data analysis, and cloud-based metabolomics platforms. For example, OWL Metabolomics and Nightingale Health are gaining traction with innovative approaches to high-throughput metabolic biomarker discovery and population-scale studies.

Strategic partnerships and acquisitions are common, as leading players seek to expand their technological capabilities and global footprint. For instance, Thermo Fisher Scientific has pursued collaborations with bioinformatics firms to enhance its metabolomics data analysis offerings, while Agilent Technologies continues to invest in automation and cloud-based solutions to streamline high-throughput workflows.

Overall, the high-throughput metabolomics market in 2025 is marked by intense competition, rapid technological innovation, and a trend toward integrated, scalable solutions. The ability to deliver high-quality, reproducible data at scale remains a key differentiator among leading players, as the market continues to expand into new application areas and geographies.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The high-throughput metabolomics market is poised for robust expansion between 2025 and 2030, driven by technological advancements, increasing adoption in pharmaceutical and clinical research, and the growing emphasis on precision medicine. According to projections by Grand View Research, the global metabolomics market—which includes high-throughput platforms—is expected to register a compound annual growth rate (CAGR) of approximately 12–14% during this period. This growth is underpinned by the rising demand for comprehensive metabolic profiling in drug discovery, biomarker identification, and systems biology.

Revenue forecasts indicate that the market could surpass USD 6.5 billion by 2030, up from an estimated USD 3.2 billion in 2025. This surge is attributed to the increasing integration of high-throughput technologies such as mass spectrometry (MS) and nuclear magnetic resonance (NMR) spectroscopy, which enable rapid, large-scale analysis of metabolites in complex biological samples. The adoption of automation and advanced data analytics further accelerates throughput and scalability, making these platforms attractive for both academic and commercial laboratories.

Volume analysis reveals a parallel increase in the number of high-throughput metabolomics studies and sample analyses. The annual volume of processed samples is expected to grow at a CAGR of over 13%, reflecting the expanding application base in clinical diagnostics, toxicology, and agricultural research. Notably, pharmaceutical and biotechnology companies are projected to account for the largest share of sample volume, as they intensify efforts in biomarker discovery and personalized medicine initiatives.

- Regional Insights: North America is anticipated to maintain its dominance, driven by substantial R&D investments and the presence of leading market players such as Agilent Technologies and Thermo Fisher Scientific. However, the Asia-Pacific region is forecasted to exhibit the fastest growth, fueled by expanding healthcare infrastructure and increased funding for omics research.

- Segment Trends: Among technology segments, mass spectrometry-based high-throughput platforms are expected to witness the highest adoption rates, owing to their sensitivity and versatility. Service-based offerings are also projected to grow rapidly, as organizations seek to outsource complex metabolomics workflows to specialized providers.

In summary, the high-throughput metabolomics market is set for significant growth from 2025 to 2030, characterized by double-digit CAGR, rising revenues, and escalating sample volumes, as the field becomes increasingly integral to life sciences research and clinical applications.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The high-throughput metabolomics market is experiencing robust growth across key global regions, driven by advancements in analytical technologies, expanding applications in precision medicine, and increasing investments in life sciences research. Regional dynamics, however, reveal distinct trends and growth drivers in North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

North America remains the largest market for high-throughput metabolomics, underpinned by a strong presence of leading biotechnology and pharmaceutical companies, well-established research infrastructure, and significant funding from both public and private sectors. The United States, in particular, benefits from initiatives by organizations such as the National Institutes of Health (NIH) and the National Cancer Institute (NCI), which support large-scale metabolomics projects and clinical research. The region’s focus on personalized medicine and biomarker discovery further accelerates adoption, with major players like Thermo Fisher Scientific and Agilent Technologies driving innovation.

Europe is characterized by a collaborative research environment and strong regulatory frameworks that encourage the integration of metabolomics in clinical and environmental studies. The European Union’s Horizon Europe program and national funding agencies have catalyzed multi-center projects, particularly in the UK, Germany, and the Netherlands. Organizations such as the European Bioinformatics Institute (EMBL-EBI) play a pivotal role in data sharing and standardization, supporting the region’s leadership in metabolomics data management and computational analysis.

Asia-Pacific is witnessing the fastest growth, propelled by increasing investments in healthcare infrastructure, rising awareness of omics technologies, and government initiatives in countries like China, Japan, and South Korea. The region’s expanding pharmaceutical and biotechnology sectors, coupled with a growing focus on translational research, are fostering demand for high-throughput metabolomics platforms. Notably, China’s National Natural Science Foundation and Japan’s Japan Science and Technology Agency (JST) are actively funding metabolomics research, while local companies are emerging as significant market participants.

- Rest of the World (RoW) markets, including Latin America, the Middle East, and Africa, are at a nascent stage but show potential due to increasing research collaborations and gradual improvements in laboratory infrastructure. International partnerships and technology transfer initiatives are expected to stimulate market entry and growth in these regions over the next few years.

Challenges, Risks, and Market Barriers

High-throughput metabolomics, while transformative for systems biology, drug discovery, and clinical diagnostics, faces several significant challenges, risks, and market barriers as of 2025. The complexity of metabolomic data, high costs, and regulatory uncertainties are among the most pressing issues impeding broader adoption and commercialization.

One of the primary challenges is the standardization of workflows and data interpretation. The diversity of analytical platforms—such as mass spectrometry (MS) and nuclear magnetic resonance (NMR)—leads to variability in data output and quality. This lack of harmonization complicates cross-study comparisons and meta-analyses, limiting the reproducibility and reliability of findings. Efforts by organizations like the Metabolomics Society to establish best practices are ongoing, but industry-wide consensus remains elusive.

Data management and computational bottlenecks also present substantial risks. High-throughput approaches generate massive datasets that require advanced bioinformatics tools for storage, processing, and interpretation. Many laboratories lack the infrastructure or expertise to handle such data volumes, leading to potential data loss or misinterpretation. According to Grand View Research, the need for robust data analytics is a key constraint, with software and informatics solutions lagging behind hardware advancements.

High operational costs remain a significant market barrier. The acquisition and maintenance of high-throughput instruments, coupled with the need for skilled personnel, drive up the total cost of ownership. This restricts access primarily to well-funded academic centers and large pharmaceutical companies, limiting market penetration in smaller research institutions and emerging economies. MarketsandMarkets highlights cost as a major impediment to market growth, particularly in resource-constrained settings.

Regulatory and validation challenges further complicate clinical translation. The lack of clear regulatory pathways for metabolomics-based diagnostics and the need for rigorous validation of biomarkers slow down the approval process. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) have yet to issue comprehensive guidelines specific to metabolomics, creating uncertainty for developers and investors.

Finally, intellectual property (IP) and data privacy concerns can deter collaboration and data sharing, which are essential for advancing the field. The proprietary nature of some analytical methods and the sensitive nature of patient-derived data require careful navigation of legal and ethical frameworks.

Opportunities and Future Outlook: Emerging Applications and Investment Hotspots

High-throughput metabolomics is poised for significant expansion in 2025, driven by technological advancements, expanding application areas, and increasing investment from both public and private sectors. The integration of automation, artificial intelligence (AI), and advanced mass spectrometry platforms is enabling the rapid, large-scale profiling of metabolites, which is unlocking new opportunities across multiple industries.

Emerging applications are particularly prominent in precision medicine, where high-throughput metabolomics is being leveraged to identify novel biomarkers for early disease detection, patient stratification, and personalized therapeutic interventions. Pharmaceutical companies are increasingly adopting these platforms to accelerate drug discovery and development, with metabolomic profiling aiding in target identification, toxicity assessment, and pharmacometabolomics studies. For example, collaborations between leading research institutions and biopharma companies are resulting in the development of metabolomics-based companion diagnostics, a trend expected to intensify in 2025 (Thermo Fisher Scientific).

- Clinical Diagnostics: The demand for non-invasive, rapid diagnostic tools is fueling investment in high-throughput metabolomics for clinical applications, including oncology, neurology, and metabolic disorders. The ability to analyze thousands of samples efficiently is making population-scale studies feasible, supporting public health initiatives and epidemiological research (Metabolon).

- Agri-food and Environmental Monitoring: The agri-food sector is adopting high-throughput metabolomics to enhance crop breeding, monitor food quality, and ensure safety. Environmental agencies are utilizing these technologies for ecosystem monitoring and pollutant detection, with government funding supporting large-scale projects (Agilent Technologies).

- Microbiome Research: The intersection of metabolomics and microbiome analysis is emerging as a hotspot, with applications in gut health, nutrition, and personalized wellness. Startups and established firms are investing in platforms that can process complex biological matrices at scale (QIAGEN).

From an investment perspective, venture capital and strategic partnerships are flowing into companies developing next-generation metabolomics platforms, cloud-based data analytics, and AI-driven interpretation tools. North America and Europe remain the leading regions for investment, but Asia-Pacific is rapidly catching up, driven by government initiatives and expanding biotech ecosystems (Grand View Research).

Looking ahead, the convergence of high-throughput metabolomics with other omics technologies and digital health platforms is expected to create new business models and market opportunities, positioning the sector for robust growth through 2025 and beyond.

Sources & References

- Grand View Research

- Thermo Fisher Scientific

- Bruker Corporation

- Metabolon

- MarketsandMarkets

- OWL Metabolomics

- Nightingale Health

- National Institutes of Health (NIH)

- National Cancer Institute (NCI)

- European Bioinformatics Institute (EMBL-EBI)

- Japan Science and Technology Agency (JST)

- QIAGEN